Pt.1 Why does my GPU cost so much?

This blog topic will be a multipart series reviewing the changing nature of PC markets along with plausible mechanisms for these changes. To answer the title question, it would be useful to know what expectations one should have for changes in PC prices over time.

Setting Expectations:

The two most expensive computer parts’—the GPU (Graphics Processing Unit) and CPU (Computer Processing Unit)—performances have vastly increased over time. The increase in performance more or less follows a heuristic called “Moore’s law”.

- According to Moore’s law the number of transistors in are expected to double roughly every 2 years implying computing power should double every 2 years. This implies CPU’s and GPU’s relative performances become outdated roughly every 2 years. Since there are multiple CPU models being conceived per primary manufacturer (e.g. Nvidia, Intel, AMD) per generation, one would expect an outdated CPU/GPU to slowly decay both in value and price over time.

- In 2013, DARPA director Robert Cowell stated Moore’s law was expected to die roughly around 2020. Transistors at a 5 nm length were expected to be too small to prevent overheating and too costly to design. The reality is expectations keep getting broken. IBM just released a transistor that was 2 nm length and Nvidia’s GPUs have exceeded Moore’s law and have 2x-3x per year in performance since 2013.

What does this all mean you by be asking? While this may seem like a lot of jargon, there is a broad point to be made. Since the evolution of CPUs/GPUs has not yet halted, one would surmise the pricing for models released in the past 0-3 years to follow the same trend as CPUs/GPUs of previous generations.

Reality:

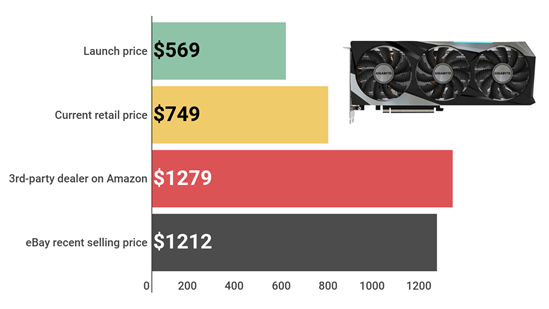

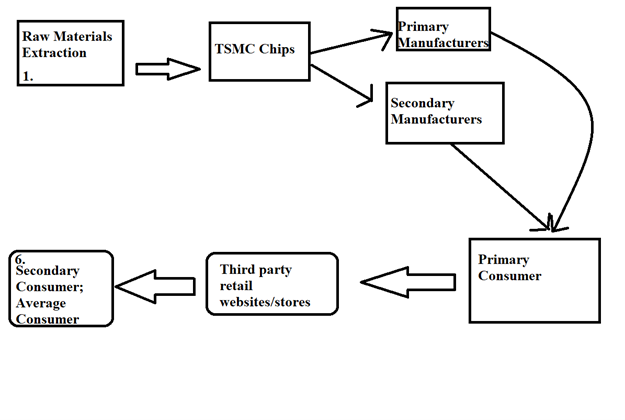

The reality is this just didn’t happen. High-end models of recent GPU generations have been skyrocketing in market price. Primary vendors are the first people to sell a GPU to the general public—hence they are necessarily the manufacturers. We can split primary vendors into two subsections. There are ODM’s (Original Design Manufacturer) who design and models their own GPUs. These include companies like Nvidia, Intel, AMD and they to tend to not sell directly to the general public. Instead, they ODMs license out their design to partner OEMs (Original Electrons Manufacturer). These partners do the literal manufacturing of GPUs that the average consumer uses. This outsourcing exists because of economics. Margins on manufacturing are low as the necessary technology to cost-efficiently produce rapidly changes. On top of this, by allocating capital to manufacturing you would be losing out on capital to R&D. Nvidia, Intel, and AMD are competing for market share in the same niche—releasing a poorly designed generation would destroy customer loyalty. With that being said, most pc-builders buy from OEMs and so it is important to look at economics for OEMs. ASUS is one such company and it has significantly marked-up its MSRP’s in 2021. They recently claimed the “rising cost of components, operating costs and logistical activities” has hamstrung supply production of the newest models. While this seems plausible, it cannot explain why you as a consumer has to pay 2x-3x more than a year ago. This begs the question whether or not the change in GPU market prices have been altered because of some outside force upstream or downstream in the supply chain.

Nvidia and AMD are the ODMs of GPUs by market capitalization. Both manufacturers use TSMC chips which are exclusively produced in Taiwan. As a result of COVID-19, shipping intercontinentally has both decreased and become more expensive. According to Tom’s Hardware, chipmakers have seen a 20-30% surge in actual production prices between 2020-2022.9 It is also claimed the consumer has not seen the effect of this price surge. Thus, it is safe to conclude that the predominant factor in price hikes for the average consumer is third-party vendors driving up prices (e.g. Amazon vendors, E-bay vendors, etc.).

At this point, you may be wondering why not just bypass the middle-man vendor? If you really want to be hands-on and build your own PC, you might as well just buy from an OEM. Well, the middle-man vendors have already beaten you to that idea! Many retailers, OEMs, and ODMs have been attempting to soft cap how many GPU a single person as a direct result of third parties buying multiple GPUs at once. Nvidia called for action as early as 2018 to deter hoarding. BestBuy is a retailer partner of and are an exclusive seller of Nvidia’s Foundry edition GPUs. Even though they are not an OEM, they sold at prices only marginally more than MSRP. BestBuy attempted to heed Nvidia’s call to action by limiting in-person orders to GPU per person for said models.

This is a step in the right direction, but curbing GPU hoarding is a tall order. If manufacturers switched the context to online orders, then OEMs/retailer may decide the method to prevent a party from buying multiple GPUs is to allow some GPUs per home address. The hoarders could try to bypass this by setting their address as a P.O. box. If the method to limit GPUs is by IP address, then hoarders could just buy proxy IP addresses. Regulating markets to preserve fairness while not harming the average consumer is a difficult task as implementation seems both bypassable, reactionary, and patchy.

The next blog post will answer the title to this post and talk about the implications of current trends in GPUs/CPUs. One thing I will tease out is there is evidence to suggest that pre-built computers, computers with parts pre-assembled by manufacturers, can be a more cost-efficient option than have a custom-built computer, computers with individual parts bought and assembled by the consumer. Since most consumers buy pre-built it may interest you to understand why this counter-intuitive trend exists.

~Ben