Fiscal expansionary policy is characterized by the government adjusting its spending levels and tax rates to increase aggregate demand. Fiscal expansionary policy has the most direct and immediate impact on the nation’s economic health, whereas monetary policies take time we do not have to take noticeable effect. We are in an emergency situation in which American citizens and small businesses urgently need relief; therefore, fiscal policy is the best solution.

Combatting COVID-19 through fiscal policy would involve government spending of some kind. This could take the form of individual stimulus checks that everyone receives, a rent relief bill for households on the precipice of homelessness, or financial support for small business. Writing every American citizen a check would provide short term relief to households trying to stay afloat, but it would not cause firms to rehire people, nor would it create a sizable increase in consumer spending. The US private savings rate reached an all-time high this summer (Bauer 2020), and we should not assume a second stimulus check will be spent on consumer goods. The best solution for boosting aggregate demand is to provide financial support for small businesses.

Over 132,000 small businesses across the US have closed permanently since the pandemic began (Adamczyk 2020), and the revenue of surviving small businesses is down by over 20% since January (Bauer 2020). While the government has approved over 500 billion dollars of small businesses loans in the spring and summer, COVID-19 cases remain out of control, necessitating business shutdowns that will likely last through the holidays.

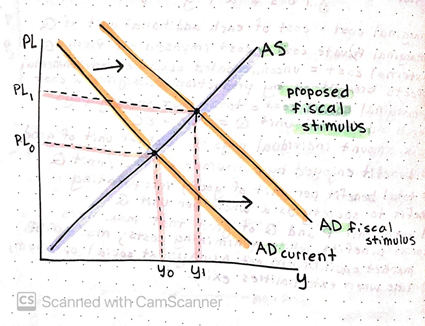

These shutdowns are necessary to safeguard public health, but without more financial stimulus, it is unlikely small business will survive in America much longer. Small businesses are responsible for a high percentage of employment in America, especially in the service industry, and dollars spent at local businesses serve to stimulate local economies, putting money back in the hands of consumers rather than corporations. Offering small businesses generous financial loans that they don’t have to pay back as long as they rehire their employees would serve to keep these essential businesses afloat, reduce unemployment, and encourage consumer spending. This would create an increase in aggregate demand (see Figure 1).

A downside of all fiscal policy, especially in these uncertain times, is that we cannot predict the future. The decision to invest government money in small business cannot be taken lately, as the prediction that it will give us the results we need (more consumer spending, less unemployment) is not guaranteed, especially as COVID-19 cases fluctuate. However, it is undeniable that small businesses are the lifeblood of the US economy; and we must support them through this pandemic to ensure that a post-coronavirus world is not dominated by large firms.

References

Adamczyk, Alicia. “7 Months into the Pandemic, Small Business Owners Don’t Know How Much Longer They Can Hold on: ‘We Are in Survival Mode.’” CNBC, 15 Oct. 2020, https://www.cnbc.com/2020/10/15/small-businesses-are-in-survival-mode-as-the-covid-pandemic-drags-on.html.

Bauer, Lauren, et al. “Ten Facts about COVID-19 and the U.S. Economy.” Brookings, 17 Sept. 2020, https://www.brookings.edu/research/ten-facts-about-covid-19-and-the-u-s-economy/.