Welcome to part one of a three part series on our presidential candidates’ stances on economic issues. There are so many candidates, I frankly don’t have room to give them all equal representation. So, NOT included in the series will be candidates with very little vote (consistently under 5%), similar stances as other candidates, and/or very little information on their tax plans. That’s Chris Christie, John Kasich, Mike Huckabee, Carly Fiorina, Rick Santorum, and Martin O’Malley. Sorry to disappoint those supporters.

This week, the issue is taxation! No presidential candidate can get by without addressing this contentious issue and how broken our federal tax system is. In order to better understand the changes the candidates want to make – and they all want to make drastic changes – I’ll overview the current system’s composition.

The federal government makes a whopping amount of its revenue on the federal income tax (in 2014, about 46%), followed by payroll taxes (34%) and the corporate income tax (11%). All the other taxes add up to just make 9% of the fed’s revenue (excise taxes, the estate tax, tariffs, etc). The individual and corporate income taxes, as currently designed, are progressive taxes, while the payroll tax is regressive. I won’t go into too much detail on what these mean (read my article about how awful Washington State’s tax system is to learn why more regressive means more inequality) but, in short, progressive taxes make people who earn more pay a bigger percentage. Regressive taxes don’t. Thanks to diminishing marginal utility for money, economics can prove regressive taxes as shafting the poor a lot more than the rich.

This wont be an article on to how to navigate your way through the no man’s land of tax forms. For that, I recommend taking Professor Lisa Nunn’s Public Finance and Tax Policy, it’s good stuff! However, some of the more obscure changes a candidate calls for will come with an explanation as to its effect.

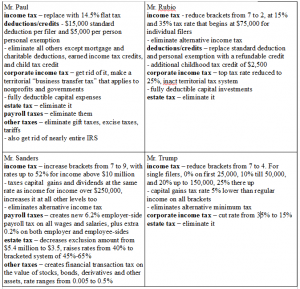

Let’s begin with a side by side comparison of all the candidates major tax propositions that I could collect from the candidate’s corresponding Tax Foundation analysis. Click the images below for a much higher quality preview.

Opinions abound, but there are a surprising number of similarities. Beginning on a harmonious note, everyone wants to get rid of the Alternative Minimum Tax (AMT). And all this hate is justifiable. The AMT is a parallel income tax system, meaning you’ve got to calculate it as well as the regular version and pay the higher, and it often ends up higher for middle-income families due to their being fewer deductions. All candidates realize the political freebie in punting away this tax code.

All Republicans plan on eliminating the estate tax, while the Democrats plan on expansion. The estate tax only applies to people on their death, and right now roughly your first $5 million is exempt. This basically means its a tax on the super rich (72% of people paying this tax are in the top 1%) , which explains why the parties stand as they do. I love Ben Carson’s website, framing the situation as “abolishing the death tax.”

Other fully-backed Republican plans (except for the unruly Trump) are first-year fully deductible capital investment, and moving the corporate income tax to a territorial system. Fully deductible capital investment means that a business can deduct the full price of any capital investment (like new equipment, machines, buildings, etc) from their taxable income for the year they buy it. This gives a huge incentive for businesses to expand since they make that money back from the deductions in taxes. Currently, the system runs on depreciation schedules, where businesses can deduct the price of their capital investment “used up” during that year. It really aids in helping businesses correctly report their total assets, and without such depreciation schedules our economic indicators like GDP would likely decrease in accuracy.

As for the territorial system, it simply means that only money made domestically by U.S. companies is considered taxable under the corporate income tax. Currently we have a worldwide system where all income generated by U.S. Businesses is up for income taxation. Clearly, this just means lower taxes for business, but it also means greater incentive for American businesses to invest abroad since they wont have to pay as much taxes as before. If I’m not mistaken, this equals jobs shipping overseas. I definitely don’t understand how this will make America great again.

As for other similarities, the Republican candidates all wish to cut the number of personal and corporate income tax brackets, as well as reduce the tax rate at each level. The Democrats are doing the opposite. Many plan on expanding the standard deduction, which will further reduce government revenue but is actually a progressive move since it saves a larger percentage of a poor taxpayers’ money than a wealthier taxpayers’. However, don’t be fooled, many Republican candidates drop the tax rate for the wealthier brackets by a lot more than the tax rate for the lower brackets, effectively countering their progressive bright spot. Mr. Cruz, Mr. Carson, and Mr. Paul all do away entirely with any notion of tax equality and charge a flat rate. Clearly, they want to rival Washington State for the least fair tax system.

All Republican plans reduce the tax revenue of the government by no small amount – many trillions over the next ten years, whereas the Democrat plans increase government revenue. If the Republicans don’t want to increase the deficit, they’re going to have to make up for this revenue shortfall with huge cuts to government spending, which, don’t worry, they’re willing to do (the topic of next weeks article). The Democrats, meanwhile, with their eye set on expanding government programs, better have calculated the revenues generated from these tax increases accurately.

Except that’s next to impossible. Sure, the Tax Foundation, a tax policy (and notably right-leaning) think tank, is resolute in its conviction that higher taxes significantly lowers production. Their algorithm produces startling bad results for Sanders, with his tax plan alone reducing GDP by 9.5%, reducing capital investment by 18.6%, dropping wages by 4.3% and slaying nearly 6 million jobs. As the Tax Foundation’s algorithm articulates, when you increase taxes, people have less spendable income and less money is thus pumped into the economy (assuming money given to the government is money burned). Moreover, taxes targeting financial investment is extra inclement, since businesses having the cash on hand to expand their productivity is what really drives GDP growth, jobs and wages. So when Sanders increases the tax rate on capital gains and adds a new tax on financial transactions, it’s a huge disincentive to invest (since you stand to make less, the riskiness is overpowering). On the other hand, wiping out taxes spurs economic growth. Take Mr. Carson, whose plan to use a flat income tax of 14.9% for individuals and corporations, and to eliminate any taxation of capital gains and dividends, outputs from the algorithm 16% GDP growth, 46.6% more capital investment, 10.9% higher wages, and 5.2 million more jobs in the long run.

As I said, this is the Tax Foundation’s code of economics. Others are not sure there’s a clear link between tax changes and macroeconomic indicators. Recent history also objects, as former President George Bush’s large tax cuts to the wealthy made barely an alteration to the economy, and definitely did not result in increased wages or job growth.

So, please, peruse the information above and form your own astute opinion on which tax plan seems the most equitable, the most economically efficient, and the most suitable for our country’s current and ideal existence.