Over the summer I worked as a cashier at a tourist shop in Seattle. That means hardly any customers were from Washington, and that means hardly anyone expected our whopping sales tax. “Oh yes, taxes,” an elder German would sigh, not used to having it left out of the price tag. A Coloradan would demand to know why it was so high – Denver has a sales tax of 3.65% compared to Seattle’s 9.5%. A Montanan would laugh and flash their ID. Any resident from the five states without sales tax – Alaska, Delaware, Montana, New Hampshire, and Oregon – have an interstate sales tax exemption that I would have to strike from their purchase and make a record of for tax compliance. Californians would unblinkingly accept the tax rate.

Standing there, watching people’s various reactions to our sales tax, got me wondering how Washington’s tax system compares to other states, and whether I should be upset about it when a group of Oregonians leave tax-free. An internet search left me stunned. Washington is home to the least progressive tax system in the United States. When I think of progressive attitudes, I’d put Washington in the top five, but our liberalness seems to have not translated into a just tax system.

You might be asking, “wait a minute, aren’t taxes generally a liberal thing, so they’re all progressive?” When I and bigger-brained-than-me economists say progressive, however, there’s a definition behind it. Progressive taxes are those that take a larger percentage from those with a larger income. If I make $50,000 a year, a progressive tax might take 10% of my income and 20% of the income from a person making $100,000. Afterwards, I have $45,000 whilst the big earner has $80,000 (I’m excluding brackets for simplicity). Many cry foul at progressive taxes because the wealthier you are the more you lose, but they forget that the marginal utility of a dollar decreases the more you have. I’d be thrilled to make $50 in 4 hours, Bill Gates would not. In other words, every dollar counts towards basic needs when you make $50,000, so losing $5,000 likely means that you’ll have to put off fixing that leaky roof. Whereas, ending up with $80,000 means you’ll still get your two week vacation or can turn your car in for that newer model. Losing 20% ($20,000) means a lot less to that fellow than if I lost 20% ($10,000).

What types of taxes are progressive? The most notable example is the graduated income tax (aka progressive income tax), where every dollar you make above certain brackets is charged at a higher tax rate. The federal income tax works this way, as do 34 state income taxes to various lesser extents. Other states have decided to collect a flat income tax, where everyone is charged the same rate no matter their income. As touched on above, being charged the same rate does not mean everyone is equally worse off, and when lower-income people face a higher tax burden than the wealthy we call that a regressive tax.

Washington is one of seven states without a personal income tax, and one of six without a corporate income tax. In their steads, we have the sales tax and gross receipts tax (a sort of sales tax on businesses) which accounted for over 60% of Washington tax revenue in 2013. Besides the fact that this means state revenue is hit hard during a recession, it means the poor are bearing an unequal burden in financing our government. Sales taxes are regressive because everyone faces the same rate, regardless of income, and the 6.5% state sales tax is often supplemented by local sales tax rates all the way to 9.5% – like in Seattle and Tacoma. In addition, Washington’s second greatest tax is the property tax, also considerably regressive, and we also have strikingly high excise taxes on gas (10th place), cigarettes (7th), spirits (1st) and weed (1st out of two).

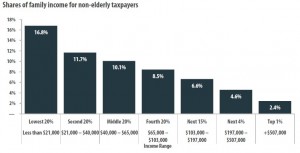

What does all this result in for Washingtonians? Even angels who don’t smoke or drink but make less than $21,000 a year (that would be my job) saw 16.8% of their income disappear into state and local taxes. Compare this to Washington heavyweights making over $500,000 a year being charged only 2.4% of their income. It’s nearly a smooth slide down from poorest to richest. According to the Institute on Taxation and Economic Policy, a liberal think-tank, Washington has by far the biggest equity discrepancy. Even Alabama has their poorest 20% paying 10.0% and their top 1% paying 3.8% of their income in taxes.

In truth, no state has the wealthy paying a higher percentage of their income in taxes than the poor, so no state has a wholly progressive tax system. Washington just wins the award for last place. If welfare is any concern for us Washingtonians, we really ought to change our tax system.

Last spring Seattle economist Dick Conway was quoted at length in a number of radio stories on radio station KPLU about the dysfunction of Washington’s tax system and a report he wrote about the possible policy solutions. The link http://www.kplu.org/post/economist-dick-conway-says-washington-s-tax-system-worst-country includes a link to Conway’s report. KPLU followed this in March with a series of reports on the history, economics, and political realities of Washington’s tax system (http://www.kplu.org/post/wash-voters-once-passed-income-tax-wider-margin-vote-legal-booze).

Thanks for your personal marvelous posting! I actually enjoyed reading it, you may be a great author.I will be sure to bookmark your blog and will eventually come back sometime soon. I want to encourage you to continue your great job, have a nice morning!