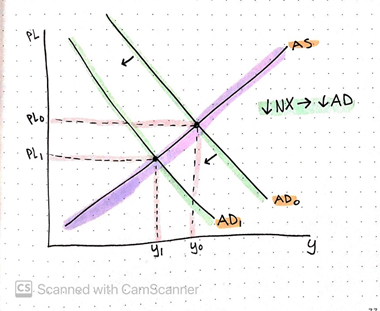

The global pandemic has disrupted supply chains in the US and worldwide: in the first half of 2020, US imports fell by 17%, while US exports fell by nearly 25%. This leaves the US with considerable deficit. While the US has run deficits in international trade since the 1970’s, the current trade situation is especially dire: the events of 2020 have widened our deficit by nearly 20% (Leibovici and Santacreu 2020). The decline in net exports, a crucial component of real GDP, is another factor in the drop in aggregate demand brought on by the pandemic (Figure 1).

There are several economic solutions available when it comes to balancing imports and exports, while simultaneously stimulating domestic growth. One option is to put in place a tariff on imports. This raises the price of goods and services from other countries and discourages domestic consumption of imports, thus reducing total US imports at a similar rate as exports and narrowing the deficit. Another option is to attempt to depreciate the U.S dollar in the global currency market. This will boost demand for U.S exports, which would lower in price, and reduce demand for US imports, which would cost more. An increase in exports accompanied by a decline in exports would increase aggregate demand, causing domestic growth.

Both options would be fine solutions were we not in the midst of a global pandemic. In most recessions, we see imports decline faster than exports, but this is not so in 2020. The US lacks a comparative advantage in medical goods, and it currently relies on foreign imports to supply essential goods for managing COVID-19; in fact, 41% of the widening in the trade deficit during 2020 can be attributed to the stream of imported medical equipment (Leibovici and Santacreu 2020).

While the catastrophic decline in exports attributed to global supply chain shocks must be addressed, any decision we make that will affect the US’s capacity to receive imports must be weighed very carefully, especially as we aim to purchase and distribute large quantities of the foreign vaccine. Taxing imports or depreciating the dollar would increase the price of these imports and could cause essential medical equipment or COVID-19 treatment to become inaccessible to the American people, causing more suffering and loss of human life.

As it stands, US imports are in high demand compared to US exports, and for good reason. We cannot afford to stifle that demand until the vaccine is widely distributed. However, if we enact fiscal stimulus for small business or individual citizens (through rent relief or stimulus checks), we will boost national spending, including on essential imports, and lessen unemployment. While this may seem counterproductive to solving a decline in exports, a greater demand for imports will increase the global dollar supply, causing the dollar to depreciate on its own. Depreciation of the dollar will narrow the trade deficit and boost net exports. This reinforces the initial fiscal stimulus, as an increase in net exports drives domestic growth.

References

Leibovici, Fernando, and Ana Maria Santacreu. The Dynamics of the U.S. Trade Deficit During COVID-19: The Role of Essential Medical Goods. doi:10.20955/es.2020.41. Accessed 16 Dec. 2020.