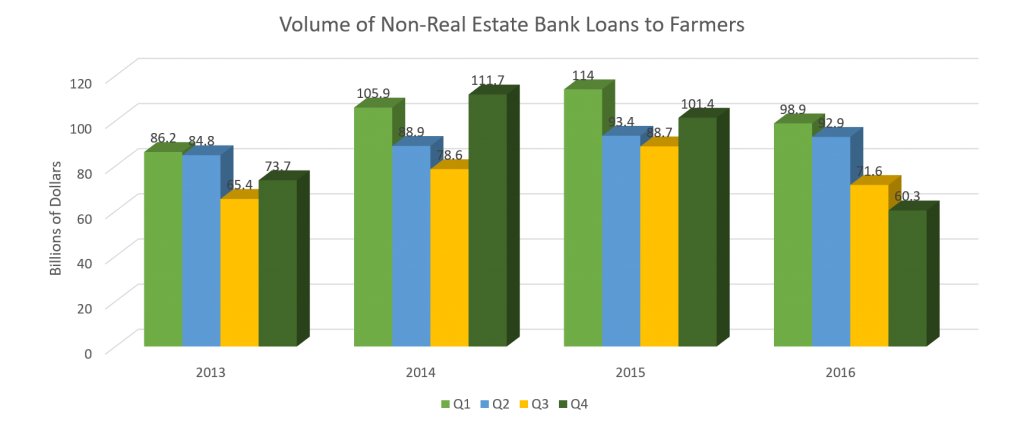

I read this article/ blog post, which touched on the cyclical nature of most agriculture. Basically, most farmers and ranchers get all of their income in a fairly small window of time, then need to use it for the rest of the year. There aren’t a lot of jobs or industries where this is such a common occurrence. Coupled with the fact that many of farmer’s costs are incurred during planting, then again as harvest approaches, this results in cyclical debt for farmers. Add in the long-term loans for land and capital, and it all adds up to significant debt. This is why it’s so important for each year to go well.

One significant expenditure in American farming is tractors and equipment, which can cost anywhere from $5,000 to $500,000. Needless to say, these aren’t impulse purchases, and most of them require significant loans which are paid off over years or decades. As the general macroeconomic outlook improves, the the Fed will likely continue to raise interest rates. This will lead many farmers to either take out loans now to beat the rising interest rates, or delay investment, depending on their expectations of the future. Since the Fed is likely to only increase the interest rate gradually, this will probably be manageable for most farmers.

While we’re on the topic, here’s one of my favorite farming puns

Have a great Wednesday!

-Max Coleman