Recently, I have written about the primary techniques to combat the negative externality of pollution: cap-and-trade and carbon taxation. For decades, politicians, economists, and environmentalists alike have debated which method is more effective. Both cap-and-trade and carbon taxes put a price on pollution and, for the most part, have successfully reduced carbon emissions and sparked innovations in sustainable energy use. Of course, because a carbon tax is a price instrument and cap-and-trade is a quantity instrument, as we have seen in my previous posts, the means to the emission reductions are quite different.

I will begin my series of comparisons with the political implications and difficulties of each carbon pricing mechanism. It is obvious that neither of these tools can be executed without government action, and depending on a state or country’s political climate, one method may be more viable than another. Not to be a pessimist, but it is no secret that the odds of the United States congress passing a national cap-and-trade system is close to zero due to the republican majority and persistent lobbying of industries that would greatly suffer from putting a price on carbon. Nevertheless, carbon-pricing programs have been both proposed and implemented on a state or regional level, and have lead to constructive deliberation.

The main political argument for cap-and-trade is that it is the only way to guarantee that the desired environmental objective will be achieved. Because such a program provides certainty about the quantity of emissions that can be produced in an industry, environmental goals are more likely to be achieved than that of a carbon tax, which only gives certainty to the prices of carbon, but not the amount of emission reductions. As environmental issues are finally becoming more urgent in the political realm, cap-and-trade programs may be seen as more effective for the sake of solving environmental problems more immediately and absolutely. On the other hand, proponents for a carbon tax argue that is that it is transparent, minimizes the involvement of the government, and avoids the creation of a new market that could be subject to manipulation. Revenue neutral taxes that target transportation and heating of cooling of buildings have been especially politically popular. For example, in Vancouver B.C., nearly all of their electricity is produced by hydropower and biomass, so there was less reason to impose the tax on power plants. This made the carbon tax proposal less politically controversial. Now, Vancouver B.C. has one of the most successful carbon tax programs in the world.

One of the biggest criticisms of the carbon tax, especially those that are carbon neutral, is that it’s too “conservative” in nature and neglects the fact that truly effective climate policy involves spending money to develop new energy systems and infrastructure. Also, depending on where the tax revenue goes, a carbon tax has the potential to be regressive because people of lower income spend a larger proportion of their income on energy. One study estimates that households in the lowest fifth of the United State’s income distribution would have to deal with a burden that is up to four times higher than that of households in the top fifth percent of the income distribution. Of course, using the carbon tax revenue to reduce sales tax or other regressive taxes can solve this problem, but this would likely go through many political obstacles.

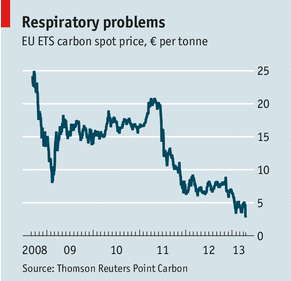

Cap-and-trade programs come with their own political issues as well. In 2013, the European Union Emissions Trading System (ETS) saw a substantial surplus in carbon allowances of about 2 billion tons, which totals to about a year’s worth of emissions. Because of the huge surplus, the price of allowances fell from a reasonable 20 euro (about $30 at the time) per ton in 2011 to only 5 euro per ton in 2013. Needless to say, government intervention had to happen in order to fix this problem. The European Commission made a proposal to temporarily take 900 million tons of carbon allowances off the market in order to strengthen the plan, which they called “backloading”. Unfortunately, the European Parliament rejected the plan by 334 votes to 315, and allowances further plummeted to a mere 2.75 euro per ton only a few months later. This obviously prompted firms to emit more for the sake of profit because the marginal cost of polluting became much lower than the marginal benefits. You can see the graph of the abysmal plummet in carbon allowance prices from 2011-2013 below.

Although both the carbon tax and cap-and-trade programs have their political barriers, carbon taxes seem to be more centrist, and with the right design that guarantees equity among every income bracket, it can be more politically palpable than a cap-and-trade program. Next week, I will discuss other comparisons between the two carbon pricing mechanisms, so stay tuned!