[This post follows up on Part Two from last week and Part One from the week before].

Over the last two weeks, I have been posting about the question: why have the parties negotiating over the future of Greece allowed a seemingly needless series of near catastrophes (followed by last-minute resolutions) to occur? Last week, I took a behavioral approach and considered procrastination as a potential contribution to the phenomenon. This week, we’ll consider a game theory point of view.

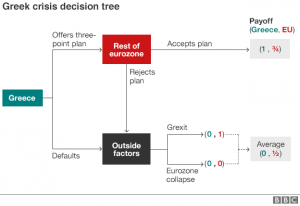

The BBC featured an interesting (and brief!) article earlier this year describing the Greek situation from a game theory perspective. It’s well worth a read (especially if you need a refresher on the basics of game theory), but if you’re reticent to click over here’s the gist. game theory is relevant to the Greek situation because the outcome for each party depends on the actions of the other party. Interestingly enough, Greek finance minister Yanis Varoufakis is apparently an expert in game theory, having studied it in a previous professional academic life. Although he claims “my game-theory background convinced me that it would be pure folly to think of the current deliberations between Greece and our partners as a bargaining game to be won or lost via bluffs and tactical subterfuge,” no doubt this analytical approach at least colors his thought processes. The BBC put together a “decision tree” visualization of the situation, which I have included below. The numbers in parenthesis represent the “payoff” for the EU and Greece, basically a numerical approximation of how good an outcome is for each party. In this diagram, “1” represents a desirable outcome and “0” represents an undesirable outcome. The best outcome for best party, the BBC claims, is another successful bailout of Greece. Although a clean “Grexit” might be preferable for the broader EU, the possibility of Eurozone collapse if a bailout plan is not reached (which would be catastrophic to the broader EU) makes failure to enact a bailout plan net unpalatable.

The key element of this situation is uncertainty. Not only are the outside factors, which would determine the actual outcome of failure to enact a bailout for the Eurozone, Greece, and the global economy, completely unknown, but the magnitude of the payoffs of different outcomes are difficult to determine and quantify. Plus, both sides lack exact knowledge of how the other might react to their actions. For example, Greek negotiators do not know the exact amount and types of austerity they must promise to implement for the broader Eurozone to agree to a bailout plan, and how much it could get away without doing. So, if both sides want to press the other as hard as possible at the negotiating table without failing to produce an agreement, a reasonable balance is difficult to determine in the absence of good information. Thus, perhaps decision makers hold off on reaching a compromise until the last minute in order to acquire more information if both (or, really, either) sides believes that this information might be to their advantage. Information gathered as a deadline approaches might be in the form of grassroots public opinion, the intensity and flavor of the media flurry around the deadline, financial fluctuations, public rhetorical reactions from the other side of the negotiating table, or any number of other forms. Viewed in this light, perhaps, the last-minute Greek popular referendum that was mounted in July appears as an effort to bring more information to the negotiating table (information, in particular, that the Greek negotiators believed would be advantageous to their position). Although, as we discussed in Part I of this series, procrastination to the deadline has concrete negative consequences, from this perspective it seems like it could be a (at least somewhat) rational choice for negotiators.