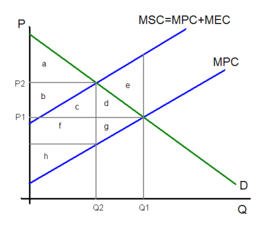

This may not be the easiest pill to swallow, but worldwide, energy prices are far too low. In the United States, on average, the federal U.S. tax on gasoline has remained at merely 18 cents per gallon since 1993. We all know that there are negative effects that come with the overconsumption of nonrenewable energy, but is it reflected in the prices? When gas, or any other fossil fuel, is bought at market price, the cost fails to account for the environmental and social impacts that come with the production and consumption of these fuels. This issue is called a negative externality. A negative externality is a non-monetary cost that is suffered by a third party as a result of a transaction. In short, the firm’s production of a good or service reduces the wellbeing of others who are not compensated by the firm. As you can see in the graph below, an unregulated market leads to an equilibrium price and quantity intersected at the demand and supply curve. The supply curve is also known as the marginal private cost (MPC), which is the cost to the firm of producing a given good or service. Both consumers and producers enjoy a surplus because the external costs are not reflected in the price. If a good has a negative externality, such as environmental degradation or an increased risk in disease, there is a marginal external cost (MEC). As you can see in the graph, when it is added to the marginal private cost, it creates a line that reflects the marginal social cost (MSC). When accounting for the marginal social cost, the equilibrium quantity is lower, and the equilibrium price is higher. In order to make the marginal private cost equal to the marginal social most, governmental regulations must pressure firms to internalize these externalities.

According to the EIA, in 2014, 66% of the United States’ energy use still came from coal, oil, and natural gas. Although coal use in the U.S. has been decreasing, it has been replaced by the use of natural gas, which still has many negative externalities. There have been many attempts to quantify these negative externalities. A report by Harvard University measured the dollar amount of the negative externalities that come with purchasing and consumption of fossil fuels, and found that all of the externalities that come with burning fossil fuels total about $345.3 billion dollars. Some of these damages include health problems caused by air pollution, ecosystem degradation caused by global warming, and even national security costs, such as protecting foreign sources of oil. A report by the Risky Business Project measured that by the end of the century, the price tag of climate impacts from consuming fossil fuels in the United States alone could total up to $507 billion dollars. Obviously, there is a huge social price tag that comes with the consumption of fossil fuels. Fortunately, there are solutions that can not only get firms to internalize these externalities, but will also help the global economy as a whole. For the next few weeks, I will talk about the various solutions, such as licensing, carbon taxes, and cap and trade programs. I will also try to spotlight various economist’s and political activist’s points of views on each method, and analyze the political implications of these policies on both a local and worldwide scale. Stay tuned!