[Written by Max Coleman]

On Tuesday October 25th, the Economics Department hosted a talk about Washington Initiative 732, a carbon tax initiative which is on the ballot for November 8th. We heard from Yoram Bauman, a University of Washington professor and “standup economist,” about why we should vote yes on I-732. Professor Bauman was one of the key economists and activists within CarbonWA, the group which brought I-732 to the ballot in its current form:

“This measure was designed to impose a carbon emission tax on certain fossil fuels and fossil-fuel-generated electricity, reduce the sales tax by one percentage point, increase a low-income exemption, and reduce certain manufacturing taxes.” (Ballotpedia)

Before I break down the measure itself, I would like to address the problem I-732 is hoping to deal with, pollution, specifically excess CO2 entering the atmosphere. Pollution is literally a textbook example of what economists call a negative externality. Essentially, negative externalities happen when the social costs from an activity are felt by society instead of the decision maker. So, one solution economics suggests is to institute a tax which makes the decision maker feel that social cost, or internalize the externality. I-732 plans to reduce pollution to a socially optimal level by making firms and consumers feel the cost of their pollution which would lead to a reduction of pollution.

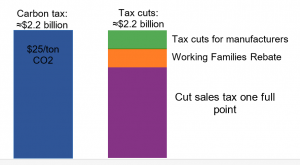

Climate change is a fact. Currently, most efforts to curb pollution revolve around environmental standards and come from the federal government. Washington’s proposal would be the first state carbon tax in the nation. The plan is to tax carbon at $25 per ton of CO2 in 2016, then increase this cost by 3.5 percent plus inflation each year for the next 100 years. What is especially interesting about I-732, is what it plans to do with the tax revenue of about $2.2 billion. I-732 achieves revenue neutrality through tax breaks for businesses, low income families, and by reducing the state sales tax by 1%. This graph breaks down about how the revenue would be distributed between those different programs.

|

One of the most interesting pieces of I-732 is its plan for revenue neutrality. This makes it more appealing to fiscally conservative voters and policy makers, because overall taxes will remain about the same. This attempt to bridge the aisle appears to be fairly successful, though it has actually drawn complaints from a very unlikely quarter. Several environmental and social justice groups, including the Sierra Club and Washington Community Action Network, oppose I-732 on the grounds that it doesn’t invest its revenue in new renewable energy and doesn’t do enough to help low income Washingtonians, who would be hit disproportionally hard by the new tax.

With regards to consumers, some of I-732’s effects are very clearly defined. One of the most concrete would be the rise in gasoline prices by 25 cents per gallon, which translates into about $150 per year if you drive around 13,476 miles a year, the current national average (FHWA). It would also increase electricity costs by about 5% per year, mostly in regions where providers use mostly coal to generate electricity. The revenue would also be used to reduce the sales tax by 1%, which would be beneficial for consumers, especially low income families who are impacted by the regressive tax currently. I-732 would also provide funding up to $1500 per year to low income families who qualify.

Overall, there are arguments for and against I-732. So don’t forget to get out their and vote!