The United States, Canada, and Mexico finalized a new trade agreement on Sunday that could overhaul the North American Free Trade Agreement (NAFTA); but, let’s back up a little bit.

In introductory economics, we learn that trade increases efficiency and thus benefits all parties involved. Different countries produce the goods for which they have the lowest opportunity cost; in other words, those countries have a comparative advantage. The maximum amount of stuff gets made and the economy is productive. This is a tight deductive argument that economists have broadly agreed on and taught since David Ricardo wrote about it in the nineteenth century. While this logic holds up, the effects of real-world trading are widespread.

Generally speaking, NAFTA has had broad benefits and specific shortcomings. It lowered the costs of many goods and added modest wealth to the US economy, but it also displaced thousands of jobs since it took effect in 1994.[1] Reasonable people disagree on the extent to which this agreement affected manufacturing jobs or helped the average American, but it seems the critics of NAFTA have prevailed politically.

President Donald Trump achieved electoral success due in part to his appeals to economically anxious working-class voters in the Midwest. We are reminded of this again as his administration introduced the United States-Mexico-Canada Agreement (U.S.M.C.A.), which will replace NAFTA, assuming it gets ratified by the three countries whose name it bears. USMCA will attempt to shift automobile production to the United States and reduce barriers for American dairy farmers, among other things.

Looking at automobile production specifically, this deal will try to incentivize the production of cars and trucks in American factories that pay relatively high wages. To do this, it will mandate a higher percentage of car parts be made in American factories to avoid tariffs; additionally, it will implement a threshold for the proportion of parts that must be produced in factories that pay at least $16 an hour in average salaries. That is approximately triple the wage of the average wage of factories in Mexico, so the administration hopes this deal will help the cause of bringing production to America.[2]

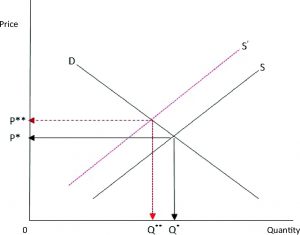

While more decently-paying jobs would be an obvious win for the American middle-class, there are second-order implications. In all likelihood, higher-wage factory workers would necessitate increases in the prices of vehicles for auto companies to remain profitable. Depending on the degree of the price increases, this could hurt middle-class Americans who want to buy a car. Pictured below[3], price could increase, thus decreasing consumer surplus.

Additionally, the $16 wage qualification does not account for inflation and will not be implemented fully until 2023.[4] This means that the effects of the “high-wage” qualification may be muted and less helpful to workers by the time it really matters.

All of this is to say that trade is complicated. Prices of vehicles and wages are likely to increase, which would imply a resulting decrease in demand and lots of deadweight loss. Conversely, this could bring many thousand decent-paying jobs to the United States. The one thing we all have in common is that none of us know. Time will tell.

[1] https://fas.org/sgp/crs/row/R42965.pdf

[2] https://www.nytimes.com/2018/10/01/business/trump-nafta-usmca-differences.html

[3]https://www.google.com/search?q=decrease+in+supply&tbm=isch&source=lnt&tbs=isz:l&sa=X&ved=0ahUKEwiywYK2xvDdAhXmxVQKHQ_iBggQpwUIIA&biw=1280&bih=618&dpr=2#imgrc=omaWOi7R28nARM:

[4] https://www.nytimes.com/2018/10/01/business/trump-nafta-usmca-differences.html