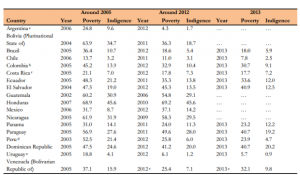

Since 2005 Latin American countries have seen an increase in economic growth, but now there seems to be a stall in poverty reduction. One country that is experiencing disastrous poverty and inflation rates is Venezuela. The country has been devastated from inflation rates at 140% and a poverty rate that jumped up to 32.1% in 2013. On top of economic distress, the extremely low price of petrol oil has been hurting Venezuela and it is now becoming apparent.

Due to this economic decline the Venezuelan President, Nicolas Maduro, has increased the price of exported petrol oil from $0.01 to $0.60 a liter. The president stated that this price raise was the right decision for Venezuela’s dire situation. Petrol oil accounts for about 95% of the country’s export revenues which explains why the low price of oil today is pushing Venezuela to economic failure.

There are a lot of factors that measure into whether or not Maduro’s plan will end up beneficial for the Venezuelan people. Oil producers have been called upon to now sell their product for $0.59 more than they recently were. This sudden change in price is tough on suppliers to deal with as they now have to begin to ask buyers for more money. Suppliers face the question of whether or not their buyers will continue to purchase at the quantity they were before the price hike. Other countries, such as Saudi Arabia also have the ability to cheaply produce oil which could harm Venezuela’s export revenue.

Another measure taken by the Venezuelan President was a devaluation of the country’s currency by 37% from 6.30 to 10 bolivars to the dollar. Maduro hopes that bringing down the value of the currency will help oil exports by making them cheaper. It seems that the president is trying to compensate for hike in the price of oil by devaluing the currency. It could be possible that both measures will find a middle ground for producers to sell at while the devaluation counteracts inflation.

Another part of this situation is the affect of devaluation on American companies in Venezuela. Many companies like Colorox and Mattel Co. are relocating out of Venezuela or thinking about it because the official exchange rate is too low. Many of these American companies value their assets at 12 bolivars or higher. It is tough to say whether these are reasonable exchange rates, but many economists believe the original 6.3 exchange rate was way too low. Now that the bolivar has gone down in value it could be possible that some foreign companies will rethink about moving their operations. But if things don’t change in the near future, Venezuela’s economy could be headed for a major economic collapse.

There is also the potential problem of the black market value of the bolivar. Steve Hanke has an estimation of the inflation rates based on purchasing power parity with his “Troubled Currencies Project”: http://www.cato.org/research/troubled-currencies-project?tab=venezuela

Here is the methodology if you want to take a look: http://www.cato.org/research/troubled-currencies

Yeah, I saw the black market issue as well. Apparently the bolivar is valued at 20 times the official exchange rate and sometimes even more than that on the black market. It seems like this could be another pressure in the background that is pushing the Venezuelan president to bring down the value of the bolivar. I could imagine that this is also causing American companies to value their assets in Venezuela at a higher exchange rate as well.