This article is a part one. Look for the second half next week!

I remember proudly voting for the legalization of weed. July 8, 2014, marked the opening of legal vendors in Washington State, and lines of Americans stretched for miles outside the few stores that qualified.

Sadly, I wasn’t 21 so I didn’t partake in that historic occasion, but plenty sure did. In the first month, Washington sold $3.8 million in pot from just eighteen stores. If that sounds impressive, one year later, a combined 160 stores were selling more than $1.4 million each day.

I’m certain that even if I was 21 at the time I wouldn’t have purchased marijuana, if only because prices spiked to nearly $30 a gram right off the bat. A simple, subconscious analysis of costs and benefits would have kept me out of those lines. Since then, prices have deflated to about $11.50 per gram, which is, at least, more reasonable.

So why did it cost so much? And will the price keep falling? I like to think I have the answer to that. There are five main reasons why the price of marijuana was/is so high: the buildup of stock, the plethora of taxes, the prohibition of entrance into the market, the unregulated substitute industries, and its federal illegality.

Buildup of Stock

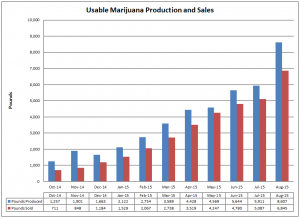

Stores opened their doors and within three days Seattle was out of legal recreational weed. Seattle’s one open store had only 10 pounds of marijuana on shelf, voluntarily limited purchases to 0.2 grams, and closed for 10 days before the store received its next shipment. That’s sloppy business. At these early stages, the few stores, farms, and processors that had been granted license only months before were still getting into the flow of operation. Farms didn’t have time to produce sufficient quantities before July 8, and these production inefficiencies, combined with pent up demand, drove prices sky-high. Now, however, as producers improve efficiency and the initial wave of novelty demand subsides, Washington has a surplus of marijuana to be sold as bud. Much of this excess is turned into extracts, like oil, but still helps drive down prices for plain ol’ weed. Now that operations and stock have normalized, and as long as forest fires or disease don’t destroy all the plantations, prices shouldn’t rise much because of supply-side factors.

Taxes

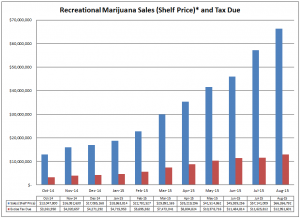

The State made more than $62 million off marijuana excise taxes in the first year, pummeling its initial forecast of $36 million. If you include local sales taxes, the total tops $70 million. Keep in mind that Washington’s two-year budget is $38 billion, but we’re still talking big money. Washington collected a 25 percent tax at three levels of supply – from producer sales to processors, from processor sales to retailers, and from retailer sales to customers. There were also the state’s B&O gross receipts tax, state and local sales taxes greater than 6.5 percent, and an ironic federal income tax. Needless to say, businesses weren’t happy, many arguing that such crushing tax levels were making them uncompetitive against illegal sources and an unregulated medical marijuana market. For instance, Cannabis City, Seattle’s first legal marijuana shop, estimated that through the end of 2014, their federal tax liability was $510,000 on top of the $778,000 owed to the state on $3.1 million in sales. Essentially, this means companies kept prices high just to stay afloat.

The government had a change of heart and introduced a bill to lower the tax burden on businesses, while possibly generating more revenue. Taking effect on July 1, 2015 was a replacement of the 3-tiered marijuana excise tax on businesses with a single 37 percent tax on retail customers. The excise tax is also no longer part of the selling price subject to retail sales or B&O taxes, meaning stores also don’t have to claim that money as income on their federal filings. Clearly, this will slash the tax burden for suppliers. Theoretically, this leads to price decreases as businesses retain a much larger proportion of sales as profit and competition works its equilibrium magic. Of course, the 37 percent excise tax is pushed onto consumers, but even so, consumers should see a price decreases because the overall tax rate has decreased.

Come back next Sunday to see the thrilling conclusion: how strict regulations are hurting, how medical marijuana poses a problem, and how the feds power to anytime end it all is a market problem. Also a comparison with Colorado if I have space!